Where there are lawyers, there are paper contracts — lots of them. A Seattle startup has come up with a way for in-house legal teams to get a handle on all those contracts with the help of artificial intelligence.

Lexion today announced a $4.2 million seed round led by Madrona Venture Group, with participation from Wilson Sonsini, Goodrich and Rosati, a legal advisor to technology and life sciences companies.

The investment from a major law firm is unusual, but speaks to the conviction that legal experts have in Lexion.

The company originated inside the Allen Institute for Artificial Intelligence (AI2). Its premise mirrors a lot of machine learning startups: find an inefficient manual process and use tools such as natural language processing to fix it.

For Lexion, that problem starts in the legal departments of mid-market companies.

“Most in-house counsel today at companies manage all their contracts using file folders, spreadsheets and email,” said Lexion co-founder Gaurav Oberoi, a Seattle startup vet who joined AI2 in February 2018.

Manual processes lead to a classic needle-in-a-haystack problem where high-paid lawyers waste time searching through contracts whenever somebody has a question about one of them.

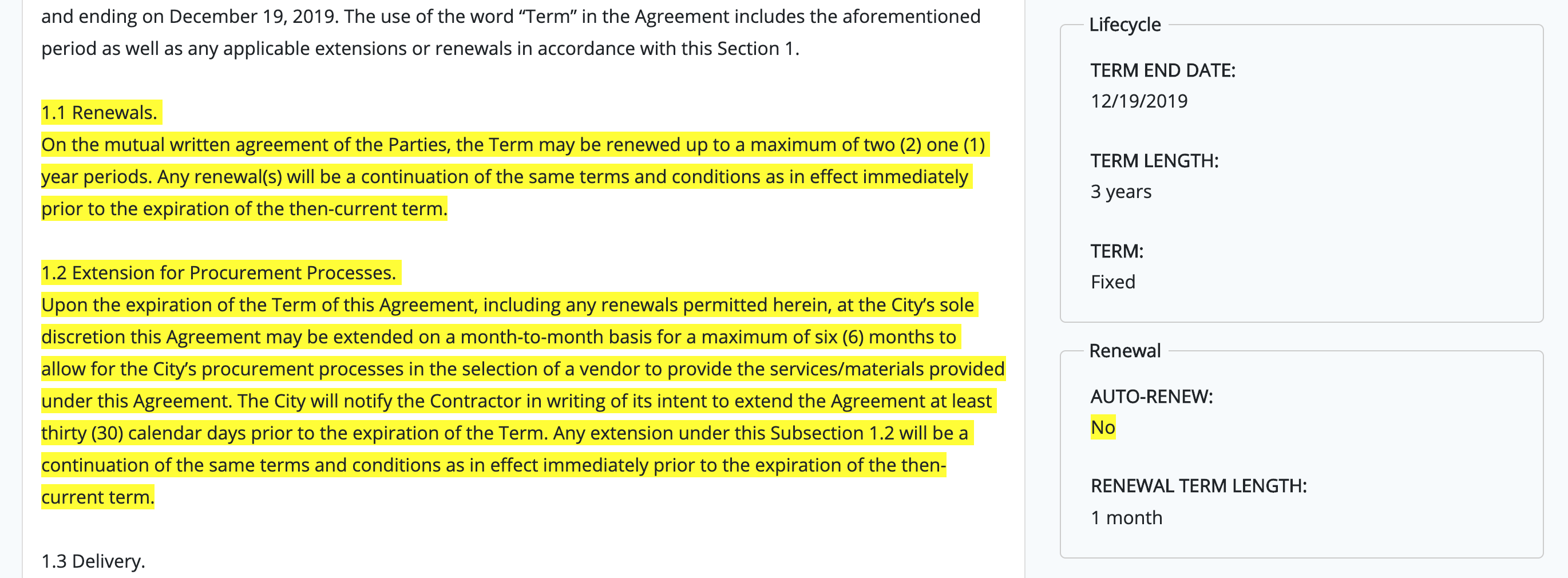

Lexion created a natural language processing system that reads contracts, organizes them, and lets users search them with a simple interface. Users can also set up notifications for important reminders, such as expiration dates.

While Lexion’s initial focus on internal legal teams is niche, Oberoi sees a larger opportunity in broader contract management for companies at a lower cost, especially among mid-sized firms.

“Natural language processing over the last 2-to-3 years has really come to maturity,” he said. “And it’s come to the point where it’s ready for commercialization.”

Oberoi was the brains behind BillMonk, a bill-splitting app that predated Splitwise. He also created Precision Polling, an automated survey startup that was later purchased by SurveyMonkey, and then went on to build SurveyMonkey Audience.

After that streak of success, the young entrepreneur took some time off. He wanted to do another early-stage company and was interested in artificial intelligence. He joined the Allen Institute for Artificial Intelligence (AI2) as an entrepreneur-in-residence and got cracking.

Among the seeds of ideas that were left on the cutting room floor: satellites, ultrasound imaging, and even exploring deepfakes, which landed him in an episode of Buzzfeed’s Netflix documentary series Follow This.

In the end, it was Lexion co-founder Emad Elwany who discovered the contract problem. His wife knew the problem all too well from her work in the procurement division of a large company.

Oberoi and Elwany joined with James Baird to launch Lexion. Elwany previously worked as an engineer at Microsoft on artificial intelligence and Baird is an engineer who came from web development firm Pancake Labs.

There are plenty of companies that help clients manage contracts, including Bellevue, Wash.-based Icertis, which became a billion-dollar company this week. But most have focused on products for large enterprise companies.

“In talking to dozens of portfolio and other middle-market and growth companies, we heard this pain point and market opportunity reiterated over and over again,” Tim Porter, managing director at Madrona, wrote in a blog post. “[Oberoi] is a tremendous founder and well-known in the tech community both for his successes in and his enthusiasm for the Seattle startup scene.”

The Lexion investment is in line with Madrona’s ongoing interest in companies that build machine learning applications, such as Lattice Data, which was acquired by Apple in 2017. Madrona also invested in AI2 spinout Xnor, which raised $12 million last year.

AI2 expanded its incubator in 2017. Another spinout, Kitt.ai, was acquired by Chinese search giant Baidu later that year.

via GeekWire

Allen Institute spinout Lexion lands $4.2M to help companies manage legal contracts with AI