Alita: Battle Angel was a groundbreaking film when it comes to integrating computer-generated characters into realistic settings, but it was far from a perfect movie. Screen Junkies pokes fun at the movie’s compressed exposition, rushed character development, silly rollerblading sequences, and sequel-bait ending.

A Complete Guide to Electronic Signatures

75 percent.

The government of Vermont cut contract approval times by 75 percent when it switched to electronic signatures. Weeks of work became days. Hours of administration turned into minutes. Workers skipped printing, costly couriers, waiting around, and filing.

A small change, like a signature, can prove powerful — 75 percent powerful. Is your organization ready to cut inefficiencies by three-quarters or more?

Some pundits forecast the electronic signature market will grow to $2.02 billion by 2020. Every organization needs signatures, and every organization wants to optimize them.

E-signatures, as electronic signatures are also known, are replacing written signatures. Not only do they save time and money, but they also create less waste and are traceable, time stamped, and more secure. Most important, they’re legally equivalent to written signatures.

Traditional “wet” signatures have been with us for thousands of years. They came in many different forms, including stamps, marks, signs, and seals. However, traditional signatures are quickly becoming outdated as new technology reshapes our world. New ways of signing are simpler and easier. E-signatures are the future that citizens and consumers want, so you need to understand how they work.

What exactly is an electronic signature? The following is a complete guide to electronic signatures: their legality, practical uses, and much more.

Legitimacy of e-signatures

Are electronic signatures legally binding? The short answer is yes. The long answer is: Different countries have different laws.

In the United States, the ESIGN Act states that electronic signatures are fully legal as long as all parties agree to use them. In addition to the ESIGN Act, the Uniform Electronic Transactions Act outlines state use of e-signatures. Similar legislation exists in the European Union.

Despite existing legislation, you might need to investigate further online. You can also consult legal counsel for more specific, country-by-country details.

In the United States, you can use an electronic signature for creating a law. Courts allow you to present an electronic signature as evidence in a court case. Moreover, a document, record, or contract can’t be denied just because it’s electronic.

Rest assured, choosing an electronic signature solution won’t harm your organization from a legal standpoint. However, providers must fulfill some conditions for an electronic signature to be legally valid:

- Demonstrate the signer had definite intent to sign. For example, provide a clear option not to sign.

- Prove the signer consented to conduct their business electronically. Most electronic signatures require you give consent before signing. Some might provide the option to complete the form on paper.

- Clearly attribute the signature. This could include an email trail, IP address, or time stamp. Some providers have a two-step identification system for signers. Although this creates an extra step for the signer, it creates a higher standard of attribution.

- Associate, or directly connect, the signature with the document being signed.

When you satisfy these requirements, an electronic signature will be legally binding. Remember that the above conditions might already be incorporated into a provider’s solution.

If electronic signatures are just as legal, why aren’t they used in every situation?

Exploring the legal framework

In some cases, an electronic signature is not perceived as appropriate. This might be the case for important documents and ceremonies such as adoption, divorce, and birth and death certificates. Multiple witnesses or a notary are sometimes required, nullifying the convenience of electronic signatures delivered remotely. Another reason for not using e-signatures is if signees aren’t computer literate.

Some key court cases have challenged and tested e-signature laws. Here are the precedents from four relevant cases:

- O’Connor v. Uber. Even if an electronic signature is on a tiny iPhone screen, the signature is still valid.

- Berkson v. Gogo. Web page design, hyperlink placement, and contract terms must not be designed to confuse or mislead signers.

- Barwick v. Geico. The phrase “in writing” can refer to a signature written electronically.

- Adams v. Quicksilver. Attribution of an electronic signature needs an auditable trail of data. Others shouldn’t be able to break into that data trail and make changes.

There’s much to learn from real-world examples. Electronic signatures feature in every part of our lives with success. Almost any industry can enjoy digitizing its sign-off procedures.

Examples of different uses

All sectors need contracts, agreements, and forms. You use them to start a company, run an employee background check, and hire subcontractors on a construction site. As a result, e-signatures are everywhere. Electronic signatures can fit in almost any industry, government, or legal application.

Here are a few cases where electronic signatures have proven successful:

- Healthcare. For a hospital department, reducing the time it takes to get signatures from doctors, patients, and insurers is vital. In one radiology department, the time needed to get signatures for abdominal examinations dropped from 11 to three days. The time needed for signatures related to chest examinations dropped from 10 to five days. By using e-signatures to shorten or skip steps in employees’ workflow, productivity rose.

Without e-signatures, the future functions of healthcare — long-distance treatment, virtual hospitals, and medical e-commerce — cannot be easily achieved.

- Industrial relations. Electronic signatures help traditional organizations get more organized. The same holds true for unions. With changes in policy regarding e-signatures, gathering employee information is much faster. E-signatures also link better with online social networks, helping spread the union’s reach. With e-signatures, unions can organize privately and with higher participation and impact.

- Small to medium enterprises. When you’re a small fish competing with whales, it helps if you can swim fast and confirm prices as they change. Agility in commerce is highly valued and for good reason.

Speed can spread to other areas, such as faster sales cycles, product iteration, and more responsive customer service. E-signatures enable leaders to buy into agility and sign contracts minutes after they’re drafted.

- Government. Petitions changed forever after the introduction of electronic signatures. Consider a public petition to cancel the United Kingdom’s Brexit deadline. It collected millions of signatures in a few months. Electronic petitions reach a wider audience and spread faster than their wet-signature equivalents.

- Family law. One of the final frontiers for e-signatures, electronic wills have been legal in Nevada since 2001. Arizona and Indiana have followed suit. Most other states still require will creators to sign before two witnesses who also sign the document.

- Disability services. The move to online information allows consumers with visual challenges to manage their business better. Handheld devices and desktop computers can enlarge document font size. Some consumers may opt to use a text-reader program to read text out loud.

- Seniors. It’s a myth that older citizens don’t use online services, like e-signatures. About 42 percent of adults aged 65 and older have smartphones. That number is up from 18 percent in 2013. Internet use and home broadband adoption among this group have also risen. Today, 67 percent of seniors use the internet — a 55 percent increase in 20 years.

- Finance. There are many different ways to use an electronic signature in finance. In the United States, credit and loan forms frequently allow e-signatures. Digital mortgages are becoming more commonplace. After February 2018, most states adopted national standards for online notarization.

According to a Federal Reserve survey, if faced with an unexpected expense of $400, four in 10 adults would either not be able to cover it or would cover it by selling something or borrowing money.

One option for covering such an expense is a signature loan, a popular method for borrowing money. The process of securing a signature loan can be improved by using e-signatures.

Electronic signature operations

What is a signature loan?

Personal lending is the fastest growing category of consumer lending. Outstanding balances in the United States rose about 18 percent to $120 billion in the first quarter of 2018.

A signature loan is a loan offered by a financial provider to an individual. These loans are sometimes known as “character loans” or “good faith loans.” The only collateral is the individual’s promise to pay and a signature.

Due to limited collateral, interest rates for signature loans can be high. They range anywhere from 5 to 30 percent and depend on the payer’s circumstances and credit record.

Signature loans are popular for debt consolidation. For example, imagine you have several large credit card debts accruing interest at rates of 20 percent or more. A bank might offer you a signature loan at a lower interest rate. After you pay off your credit cards with the loan, you then pay back the loan amount to the bank. You save money because the debts are consolidated and the interest on the loan is reduced.

Signature loans are also an alternative to a secured loan if you need to make a large one-time payment. In the wake of the 2008 credit crisis, signature loans became a popular choice because they don’t put your home equity at risk. However, because there’s no collateral, a financial provider might demand higher interest. Alternatively, they could demand a more stringent repayment schedule.

Before taking out a loan, always compare different financial providers, the products they provide, and the fees they charge. Shop around to find the best option for your situation. Repayment methods for signature loans can vary; they include

- Variable rate. The interest rate is based on a changing index and can fluctuate over time.

- Fixed rate. The interest rate remains the same for the life of the loan.

- Payday. Also called cash advances, these small, short-term loans often have higher interest.

- Convertible. This type of loan can convert into shares or stock and often has lower interest.

- Single-payment. The principal and interest on this type of loan is repaid in one payment on an exact date.

Some financial providers, like SoFi, consider more information than a borrower’s credit score. They also consider your occupation, education, and the possibility of a cosigner.

By using e-signatures, online lenders can process applications immediately and furnish a decision within few minutes. Depending on the financial provider you choose, you can receive a signature loan within a few hours or by the next day.

E-signatures are not only useful for financial services. They’re now an everyday part of many software solutions, including Microsoft Office and Adobe products.

Adding or removing an electronic signature from a Microsoft Word or Adobe PDF document

While it might be 35 years old, Microsoft Office is still a dominant software suite in the business world. Keeping up with the times, Office products, such as Word, now integrate e-signatures into documents.

Signing Word files may seem daunting, especially if you’re used to pen and paper or you’re not familiar with the software. First-timers or anyone who needs a refresher on how to sign Word or PDF documents can benefit from this guide.

First of all, it’s important to understand the difference between electronic signatures and digital signatures. This guide discusses the electronic signature, the equivalent of your handwritten signature. An e-signature is merely an image of your signature overlaid on a Word or PDF document.

On the other hand, a digital signature is cryptographically secure data. It verifies that someone with your private signing key has seen the document and authorized it. It’s very secure, but it’s also more complicated. Digital signatures are the online equivalent to a notarized signature. Refer to the next section in this guide for more details on digital signatures.

Using an e-signature line in a Word document, you can request information about the signer and provide instructions. When an electronic copy goes to the signer, this person sees the signature line and a notification requesting their signature. The signer can

- Type a signature

- Select a picture of an inked signature

- Write a signature by using the inking feature on a touchscreen computer or other device

How to create a signature line in Word or Excel (Office 365 or 2019):

- In the document, place your cursor where you want a signature line.

- On the Insert tab in the Text group, click the Signature Line list. Then, click Microsoft Office Signature Line.

- In the Signature Setup dialog box, type the information that will appear beneath the signature line:

- Suggested signer: the signer’s full name

- Suggested signer’s title: the signer’s title, if any

- Suggested signer’s email address: the signer’s email address, if needed

- Instructions to the signer: instructions for the signer, such as “Before signing the document, verify that the content is correct”

- Select one or both of the following checkboxes:

- Allow the signer to add comments in the Sign dialog box: The signer can type in the purpose for signing.

- Show sign date in signature line: The date the document was signed will appear with the signature.

To add additional signature lines, repeat these steps.

If the document remains unsigned, the Signatures Message bar appears. Click View Signatures to complete the signature process.

To remove electronic signatures from Word or Excel, follow these steps:

- Open the document or worksheet that contains the electronic signature you want to remove.

- Right click the signature line.

- Click Remove Signature.

- Click Yes.

In addition, you can remove a signature by clicking the arrow next to the signature in the Signature Pane and then clicking Remove Signature.

Alternatively, you might require an electronic signature in a PDF document. See the next section for how to use e-signatures in PDF files.

Electronically signing a PDF file

Adobe’s Portable Document Format (PDF) is a common format for fixed-layout documents. Like Word, Adobe PDF has added a range of capabilities since it was introduced to the market in 1993. It’s now possible to electronically sign a PDF file for authentication.

If you’re a Windows user, you’re probably familiar with PDF readers. They are computer programs that allow you to open PDF files, that is, files with the .pdf file extension. The most popular option these days is Adobe Acrobat Reader.

To add an electronic signature to a PDF, follow these steps:

- Open the PDF file in Adobe Acrobat Reader.

- Click on Fill & Sign in the Tools pane on the right.

- Click Sign, and then select Add Signature.

- A popup will open. Select an option — Type, Draw, or Image.

- Click the Apply button.

- Drag, resize, and position the signature inside your PDF file.

For further information on how to add an electronic signature to a PDF using third-party tools, refer to our complete guide to editing PDFs.

Knowing how to sign PDF documents will give you an edge in today’s online world. For more of an advantage, you may need to be familiar with the language and technology surrounding digital innovations. The next section will look at one of the most confusing aspects of e-signatures.

The difference between e-signatures and digital signatures

“The [Digital Signature] Standard specifies a suite of algorithms that can be used to generate a digital signature. Digital signatures are used to detect unauthorized modifications to data and to authenticate the identity of the signatory.” — National Institute of Standards and Technology

Digital signatures and electronic signatures might sound alike, but they’re quite different. Digital signatures are cryptographic “nuts and bolts.” An electronic signature might just be a typed word, ticked box, or recorded voice. A digital signature is technology that uses complex mathematics to encrypt and decrypt data. This behind-the-scenes encryption is what makes electronic signatures work.

Digital signatures use PKI as a way to verify the identity of a signer. PKI uses two keys, one public and one private, for unique identification. Both the sender and recipient have a digital certificate from a certificate authority. These digital certificates work together like a driver’s license or passport and an ID reader.

For example, Company One needs Alex to sign a contract renewal. During the process, Alex signs using her private key, which encrypts the contract. Alex also gives Company One her public key. If the public key provided to Company One cannot decrypt Alex’s signature, the digital signature is rejected.

Depending on which digital or electronic signature you’re using, you might need to take extra steps for additional security. For example, you can use two-factor authentication. When triggered, it attempts to authenticate your identity by sending a message to your mobile phone. It makes sure the person signing is you and not someone using your login or key.

You may not always need such a high level of security. For low-risk scenarios, there are simpler security options offered through electronic signature providers. Do low-security options affect the validity of a signature? Not necessarily. For example, an e-signature provider without a digital signature can still identify a valid audit trail. They could get it by examining IP address, time stamps, or browser information.

When choosing an e-signature or digital signature solution, your organization will need to balance the needs of security, time, and cost.

As mentioned previously, both e-signatures and digital signatures are legitimate signatures. According to the ESIGN Act, an electronic signature does not have to be a typed name. What other types of signatures are acceptable?

Other e-signature types

Along with digital signatures and e-signatures, other types of electronic signatures are becoming commonly available.

Click-to-sign. A click-to-sign signature is a situation where a single click of the mouse signs the document.

There are legal conditions to be aware of if you’re using a click-to-sign solution. With click-to-sign signatures, the legal principles of intent, consent, attribution, and association still apply. For example, the signer must intend to click and consent to doing business this way. The signature needs an auditable trail of data that attributes the signature to the individual. Finally, the data needs to be directly associated with the document.

Before using click-to-sign on your documents, check local laws regarding these signatures. In most of the United States, click-to-sign is legally binding. Across the border in Canada, investment dealers can use e-signatures.

Blockchain. Originally used in cryptocurrencies, blockchain is now finding uses in mainstream industries, such as monitoring supply chains in fashion. The technology is useful for determining the authenticity of transactions using a distributed ledger. Blockchain is great for maintaining accountability, for example, of currencies like Bitcoin. However, it may not be as useful for situations when an individual or organization wishes to be anonymous.

Biometric signatures. Biometric signatures use information about your body to verify authenticity. They add a part of your body that’s unique to you, such as

- Fingerprints. Not just used at a crime scene or an airport anymore, fingerprints are now crucial to consumer technology. Fingerprint scanners are found on smartphones and on credit cards in the United Kingdom. While they provide extra security, they are not as safe as you might think. Researchers have developed “deep master prints” that can hack fingerprint scanners.

- Hand geometry. This method calculates the finger lengths and palm size of users.

- Eye scans. Eye scans analyze the patterns of blood vessels in the retina or colors and lines in the iris. These scans are difficult to fake because the patterns are unique to each person.

- Face ID. Infrared dots shoot out and measure a unique 3D face image. Used in the iPhoneX, Apple claims Face ID is 20 times harder to break than its fingerprint scanner.

- BioSig-ID. This authentication software captures unique movements and gestures as the signer draws a four-character password with a finger, stylus, or mouse.

While biometric signatures are harder to forge, they’re also harder to replace. For example, you can quickly create a new password if someone guesses yours. However, you can’t really come up with a new face if someone hacks your Apple Face ID.

Both complex and simpler types of signatures will continue to have their uses. The type of signature you choose will depend on the reason you need the signature. The level of security and sophistication should match the occasion.

In the next section, we’ll examine some common scenarios when you might need an e-signature.

When you need e-signatures most

Legally, you can use an electronic signature anytime you need a signature.

Practically, there are situations when you need simplicity, security, convenience, and a low cost. In these cases, you need an electronic signature.

Here are some more common scenarios when you need an e-signature:

- When you need a simple and intuitive solution. Streamline your HR services with electronic signatures. Consider using them on time-sensitive documents, like time sheets, tax forms, and onboarding forms for new hires.

- When you need high-level security. When dealing with highly personal information, you need 100-percent assurance. This could include retention or fee agreements, confidentiality agreements, or power of attorney agreements. In these cases, an e-signature could provide strong insurance through an auditable trail.

- When you need convenience and speed. Legal services, such as class action communications, might have to go out to hundreds or thousands of people. A quick batch of e-signatures could save you hours or even days. In retail, you could use speedy e-signatures to make sales and sign purchase orders and invoices. It’s sure to impress technologically minded business associates and keep business moving.

- When you need to lower costs. In finance, you’re always seeking to cut costs. With e-signatures, you could open, maintain, or close accounts at lower costs by eliminating shipping fees. Similarly, insurance companies can cut the costs of claim assessments or policy agreements by having customers sign online.

Collecting signatures via an online form can get rid of a lot of inconvenience. Instead of sending out forms and waiting for them to come back, you can receive signed documents from anyone at any time. To get that level of convenience, how can you set up signature forms on your website?

How can you apply e-signatures to your JotForm forms?

JotForm accepts electronic signatures, enabling you to authenticate, identify, and secure your form.

Creating an electronic signature for your form is simple. It only takes three steps:

- In the Form Elements menu, add E-Signature to your form from the Widgets tab. The e-signature widget allows signers to draw their signature using a mouse, finger, or other input device. The widget requires no additional configuration, and you can resize it to fit your form layout.

- Use the Properties menu to configure additional settings:

- Required: requires a signature to submit the form

- Hover Text: text that appears when the cursor hovers over the signature box

- Sub Label: text that appears below the signature box

- Duplicate: copies the field with all of the same settings

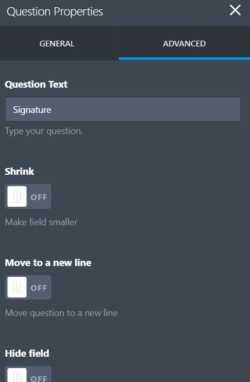

- In the Advanced Properties tab, refine the look of your e-signature using

- Question text

- Shrink

- Move to a new line

- Hide field

Remember that signers must consent to provide their signature electronically for it to be legally binding. This also applies when they are completing your form. For example, if a signee makes a financial decision to subscribe to your service, you must establish clear consent. Otherwise, you could face legal action down the road.

The popularity of e-signatures continues to grow. Globally, the amount of e-signatures is projected to grow 34.7 percent annually. Which companies are embracing electronic signatures and offering new solutions?

Electronic signature apps and software

When selecting an e-signature provider, there are a few factors you should take into account:

- Price. Some providers offer products exclusively for business and can be expensive. Others cater to lower budgets. Most offer multiple products and services and free introductory trials.

- Security. Check the technical specifications the provider uses for identification and authentication. Not every company will use digital signatures. Another issue may be customer service availability — who is available to fix your problem if and when one occurs?

- Experience. Has the provider worked with companies of your size in your industry? Read reviews from their customers.

- Integration. How will the e-signature service work with your existing software? This could have a significant impact on your ability to streamline your workflow.

Also, be sure to look for solutions that include the features your organization needs. Depending on your business, you might need

- Custom branding for your signatures

- Scalability, depending on the size of your company and the number of users who will need to use the service

- Regulatory compliance to meet the laws that govern your industry

- Reporting, workflow visualizations, and dashboards for managers to track progress

- Notifications and reminders that prompt signers to complete a signature

- Mass signatures for sending out signatures to a large number of people at once

There are many e-signature providers available, and many will likely satisfy your needs. To find the best fit, check the features different companies provide and weigh them against your business needs.

Here is a rundown of the most popular e-signature providers on the market today:

DocuSign

- High price

- First-class security

- Good for large enterprises

“DocuSign is the largest e-signature player by market share and will maintain this position for the foreseeable future.” — Neil Wynne, How Will DocuSign Going Public Impact the Electronic Signature Market?

Founded in 2003, DocuSign pioneered some of the key technologies used in e-signatures. Today, the company has more than 475,000 customers and hundreds of millions of users across the world.

You can use DocuSign’s cloud platform. DocuSign works on Mac and Windows, and it integrates with Google, Salesforce, and many other apps.

DocuSign offers excellent security and encryption solutions. It’s the only provider to be ISO 27001 and SSAE 16 certified. In addition, DocuSign also complies with the xDTM Standard — the transaction management standard for an open, digital world.

It all adds up to a first-class service at a first-class price. Individuals or casual users pay $10 per month. The standard plan for multiple users is $25 per user per month. If you’d like to try DocuSign, it’s also available as a 30-day trial.

Adobe Sign

- Trusted name in software

- Experienced and secure

- Good for large organizations

As the second biggest player on the e-signature market, Adobe offers a trusted solution suited to professional use. In fact, many choose Adobe based simply on reputation. It’s one of the most well-known and trusted names in software.

In 1999, Adobe introduced some of the first digital signatures in Adobe Acrobat and Adobe Acrobat Reader. Since then, the company has worked with experts and certificate providers across the industry to create an open standard.

Today, Adobe is the “first global vendor to deliver open, standards-based digital signatures for web and mobile.” The company has worked with experts in the Cloud Signature Consortium to set up a new global standard.

Adobe Sign provides world-class compliance and authentication features built in. It’s also Microsoft’s preferred e-signature solution, so you can take care of signature tasks without ever leaving Office 365.

Pricing for a single user is $9.99 per month. For two to nine users, you’ll need to sign up for Adobe Sign Team, which costs $24.99 per person per month. The price for 10 or more users is $39.99 per user per month. A free 14-day trial is also available.

SignEasy

- Mobile and simple

- Fast and easy to use

- Good for business use

SignEasy’s focus has been on mobility and simplicity. Founded in 2010, SignEasy features secure sockets layer (SSL) technology to encrypt all data transferred between the application on your device and their servers.

Reviews are very positive; however, some reviewers have noted slight interface glitches, lengthy loading times, and the lack of company branding options.

SignEasy uses secure servers at Amazon Web Services to store your files, and only you can access the files with your user credentials. SignEasy works with a variety of apps, including Gmail, Zoho, Google Drive, Dropbox, and Evernote. Users can also sign without leaving the applications they’re working in.

The price is on par with other solutions at $10 per month for individual users with limited needs. To access additional features, other individual plans are priced at $15–$20 per month. Finally, the rate for teams is $60 per month for up to three users. SignEasy also offers a 14-day trial.

KeepSolid Sign

- Modestly priced

- Simple to use

- Offers useful templates

As the name implies, KeepSolid Sign is a sturdy mid-level solution for everyday mobile and multidevice needs. It’s a native app for iOS, macOS, Android, and Windows.

Established in 2013, this newer player on the market does not yet support digital certificates and digital signatures from a Certificate Authority. However, it’s not a lightweight on security. KeepSolid Sign comes with military grade AES-256 encryption.

In reviews, users have noted the handy templates that can reduce the time needed to prepare documents. Some reviewers have observed that the interface might not be suited for larger, more complex tasks.

In terms of cost, KeepSolid is relatively inexpensive. It comes with a 14-day trial, and the single-user rate is $9.99 per month. Teams with up to five members pay $34.99 per month, and larger teams of 10 or less pay $64.99 per month.

Secured Signing

- A cheap solution for low-volume needs

- Fast (according to reviews)

- Versatile for individuals or business

Founded in 2008, this New Zealand-based company offers some impressive features.

Secured Signing includes a cloud-based digital signing service, including a signing workflow with invitations, automated reminders, and signing progress in real time. The X.509 digital signature technology that underpins Secured Signing ensures the authenticity of signees and documents.

While customer reviews stress that the program is fast, some have complained about a confusing interface, lack of features, and no mobile app.

The basic plan is free if you need to send three documents or fewer a month. For up to 10 documents a month, there’s a pay-as-you-go rate starting at $9.95 per month. For companies with higher volume, the team edition starts at $24.95 per month. The price varies based on the number of users and the number of documents sent.

OneSpan

- More expensive

- Long list of features

- High customer satisfaction

Formerly eSignLive by VASCO, OneSpan emphasizes its record of working with governments and regulated industries. Founded in 1991, OneSpan has over 10,000 customers, including more than half of the world’s top 100 banks.

Customer reviews mention ease, flexibility, and security as some of the software’s positive qualities.

When it comes to maintaining trust and achieving the highest completion rates possible, brand consistency is a large concern for big organizations. For a reasonable cost, OneSpan allows companies to deliver highly personalized digital experiences that put their brands front and center.

OneSpan leverages its experience by offering a generous 30-day free trial. After that, it’s $20 per user per month.

Why electronic signatures are essential

Signatures have come a long way since early scratchings on cave walls. As history and technology have shaped society, our signatures have changed as well.

Electronic signatures have countless advantages over wet signatures — they’re fast, environmentally friendly, cheap, and traceable. E-signatures also have many uses in everyday life and business. Today, the market for e-signatures is growing thanks to global commerce, security concerns, and environmental awareness.

The world produces more than 400 million tons of cardboard and paper annually. You can help end the waste caused by printing documents to be signed. Your adoption of new technology will impress your staff while improving your business.

Ultimately, the focus should be on customer convenience. Consumers want more control and choices through online services. Banks have already learned this lesson: 40 percent of consumers say their mobile phone is their principal device for interacting with their bank.

Adapting to new technology is a challenge. However, technology offers many rewards and the opportunity to get more people excited about your organization. Don’t leave electronic signatures out of your operations. E-signatures not only make your operations faster and cheaper — they also make work that much easier.

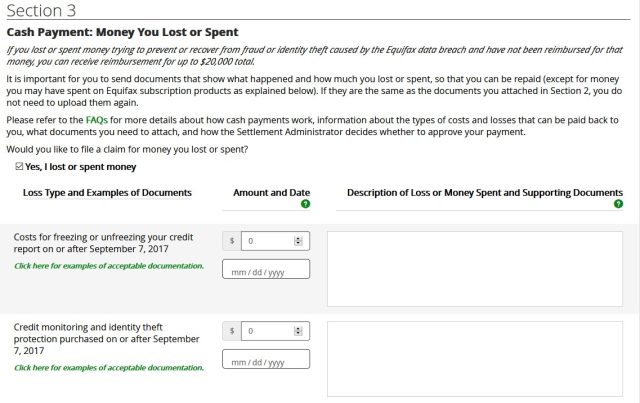

You can go claim at least $125 from the Equifax settlement right now

Bloomberg | Getty Images

There is at long last a silver lining for the 144 million of us who had our personal data leaked in the gigantic 2017 Equifax data breach: cash money.

Under the terms of its settlement with the Federal Trade Commission, Equifax established a fund of at least $300 million to compensate individuals who had their data compromised.

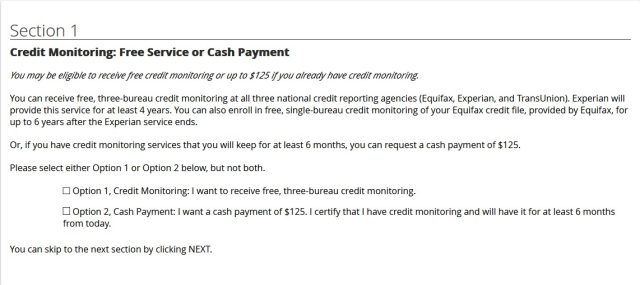

You, the individual, get to choose which claim to file: up to 10 free years of credit monitoring service, or a $125 check.

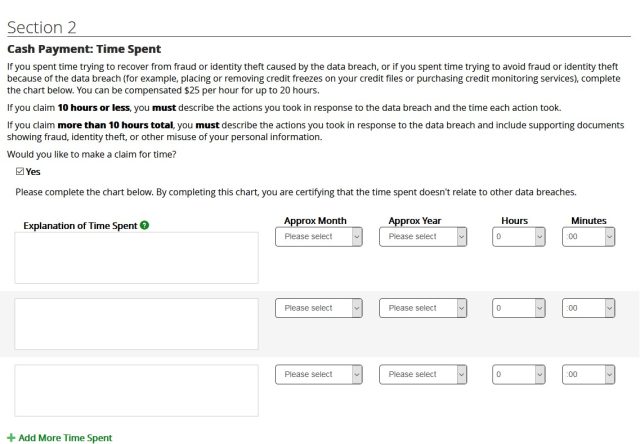

Additionally, you may also be eligible to claim up to $500 in compensation for time you spent dealing with the fallout of the breach, and up to another $20,000 if you suffered identity theft you can tie back to it.

How to choose?

Ars is by no means a financial advisory site. But if you can, claim the cash. Credit monitoring can be a useful service, but it generally has major limits and doesn’t really protect you from fraud.

Here’s the catch for this Equifax offer: You can only claim the cash in the settlement if you certify you already have a credit monitoring service. Luckily, there’s a very good chance that you do, or you easily could without much trouble.

Many banks, credit unions, and credit card companies offer free credit monitoring services to customers through a partnership with one of the three major credit bureaus (Equifax, Experian, and TransUnion). Services like AAA, professional organizations, and alumni organizations also frequently offer low- or no-cost credit monitoring programs through similar partnerships.

If you dig around in your wallet and your inbox, there are decent odds you’ll find you already have an affiliation with some entity that can hook you up,

You may even already have free credit monitoring services as the result of a previous data breach (including even this one), as it has become standard practice for everybody and their grandmother to offer it to consumers following a “cybersecurity incident.”

How to apply

Filing a claim, at least, is reasonably straightforward.

Step 1: Check your eligibility. Use the eligibility lookup tool to see if you were among the 144 million US residents who was affected by the breach.

If the answer is no, congratulations! Your data is doubtless still included in dozens of other breaches, of course, but not this one. Lucky you. If the answer is yes, proceed to…

Step 2: File a claim. You can use an online form or, if you prefer, send in a paper claims form.

On the first page of the online claim form, fill in your personal information and click next. The second page will ask you to choose what you want to claim: cash or credit monitoring. Selecting either option will bring up an explanation of your choice. If you select credit monitoring, you will also have the option to add an additional six years of service, provided by Equifax, to the initial four years provided by Experian.

Once you’ve chosen between credit monitoring or the $125 check, the next page gives you the option to claim compensation for up to 20 hours of time spent dealing with the breach at $25 per hour. If you don’t want to claim any hourly compensation, just hit “next.” If you do elect to claim time, and specify more than 10 hours of work, you must upload supporting documentation showing what you did.

Finally, the form will ask if you lost or spent money as a result of trying to prevent or recover from identity theft linked to the incident. If you select “yes,” you will be presented with a form asking you to provide detailed information and to upload documents supporting your claim. Funds spent freezing your credit or paying for credit monitoring in the wake of the breach are eligible for recompense in this section.

Finally, you select how you want to be paid any compensation (in cash or on a prepaid debit card), review your answers, and sign to submit. Take a screenshot or save a PDF of your claim confirmation number after you submit just in case.

For more information, the Equifax Breach Settlement site has a detailed FAQ, or you can read about it on the FTC’s website.

via Ars Technica

You can go claim at least $125 from the Equifax settlement right now

Old-school Doom and its sequels come to Switch, Xbox One, and PS4

Thinking about what to do this weekend? Think no more. Doom, Doom II, and Doom 3 have all just appeared on the Switch, Xbox One, and PS4, giving you no excuse not to play these classics. All the time. Over and over. Rip and tear!

The announcement was made at QuakeCon 2019, the annual gathering of slayers and gibbers where id Software usually shows off its latest wares. Or in this case, its earliest.

At $5 each, the original Doom and Doom II should provide dozens of hours of old-school fun. I’ve found in revisiting these games that the level design really is spectacular and the gameplay, while of course simple compared to your Dishonors or your Division 2s, is also elegant and carefully calibrated. It’s also amazing how scary these games can still be.

Play the games that started it all. DOOM, DOOM II, and DOOM 3 are all available now on Nintendo Switch, Xbox One, and PS4. #DOOM25 #QuakeCon pic.twitter.com/aZwEfnJaP0

— DOOM (@DOOM) July 26, 2019

Not that you haven’t had ample opportunity to play them — and the thousands of free maps available for PC players — these last couple decades. But if your console of choice, with your surround sound system and big screen, is how you tend to play games, then perhaps it’s worth a tenner to put these enduring classics on there.

Importantly, these include 4-play split-screen deathmatch and co-op. Probably been a while since you played it that way, right?

As for Doom 3 — well, my most salient memory of the game is playing the leaked Alpha version, which scared the pants off me and almost put me off the actual game. It was a huge graphical advance at the time and due to its deliberate use of lighting still looks pretty cool, though of course highly primitive in other ways.

Is it still any good to play? $10 lets you find out.

The original two games are also officially available on iOS as well, and will, amazingly, run at about a dozen times the resolution they originally did back in the ’90s.

via TechCrunch

Old-school Doom and its sequels come to Switch, Xbox One, and PS4

Zombieland: Double Tap (Trailer)

Director Ruben Fleischer returns to the world of the undead along with Woody Harrelson, Jesse Eisenberg, Abigail Breslin, and Emma Stone as their dysfunctional post-apocalyptic family faces off against new kinds of zombies on a road trip from the East Coast to America’s heartland.

The New Trailer For The Harriet Tubman Movie Is Out, and It’s Guntastic

Cynthia Erivo in “Harriet” (2019). (IMDb)

I’ll admit up front that I’m a history nerd, particularly American history, and I get a little excited when Hollywood makes a great movie that helps us learn a little more of our shared story in an entertaining and engrossing way. It looks like director Kasi Lemmons has done exactly that with “Tubman”, the bio-pic of escaped slave and Underground Railroad conductor whose heroic deeds brought dozens of men, women, and children out of bondage.

I counted a gun in the hands of Tubman at least six times in the 2:40 second trailer, which is a pretty good assumption that Lemons isn’t going to gloss over the fact that Tubman’s ability to free slaves depended, at least in part, on her willingness to defend herself from those who were trying to kill her for her efforts.

The firearms that we see in the trailer are wielded both by hero and villain. They’re tools that protect freedom and oppression equally, depending on the motives of those who possess them. In the hands of the black Union Army regiment that we briefly see, they are tools of liberation. In the hands of the U.S. Marshall enforcing the Fugitive Slave Act, or in the hands of the private slave catchers, they are tools of compliance with an unjust law.

Gun control activists may not be happy about this even-handed portrayal. After all, gun control groups have a lot of allies in Hollywood, and they’ve been successful at introducing anti-gun plot lines into Hollywood productions. I’m sure they’d much prefer Harriet Tubman simply use her brain to work her way out of the terrifying moments where she was close to discovery, capture, and death. Why does the hero need a gun?

Well, the answer is she would have likely died without one, and it would be an egregious misrepresentation of history to pretend otherwise, just as egregious as having the slave catchers use sweet words and the promise of a $15 an hour minimum wage to lure slaves back to their masters. The Civil War was force on force on a massive scale, and the trailer for Tubman shows how force was a part of how the conflict played out among individuals, both private citizens and officers of the State, before and during the war. At its heart was a fundamental disagreement over what freedom meant.

Did freedom mean the ability to live as your own person, to work where you chose, to live together in marriage without someone splitting your family apart in order to make some money, to raise your children as your own? Or did freedom mean the ability to own property without fear of government reprisal or private interference, even if that property happened to be a human being? Did freedom mean the ability to maintain your way of life at the expense of your property having to endure their own?

Thankfully our American ancestors chose the first definition, but not without a great deal of blood and treasure spilled, and not without great risk and cost to themselves and our nation. I don’t view our nation’s inability to deal with slavery at the time of the writing of the Constitution as an original sin that can never be forgiven or washed away, but as a near fatal flaw. The Civil War was the tragic culmination of the inability of the Founders to bring the framework of government fully in alignment with its principles that all men are created equal and are endowed by their Creator with certain unalienable rights like the right to live, liberty, and the pursuit of happiness.

Sadly, though, we’re still engaged in a political battle over the definition of freedom. Think about all of the gun control laws that Harriet Tubman violated in the trailer above. Did Tubman have a license for that pistol she was carrying? How’d she get that gun anyway? Clearly she didn’t go through a background check, because she would have shown up on the National Instant Check System (And Fugitive Slave Recovery Tool). Wasn’t that rifle she was using the same or similar high-powered weapon of war used by the Union troops? Some people clearly thought Tubman was crazy for going into the South to free slaves. Shouldn’t they have tried to use a red-flag firearms law to take her guns away? If today’s Democrats had their way (actually, if yesterday’s pro-slavery Democrats had their way too), Harriet Tubman would be looking at decades behind bars in a federal prison.

We can still find heroes in the most tragic of circumstance, and Harriet Tubman is unquestionably one of them. On a scale of “I’ll rent this from Redbox” to “I’ll drive an hour to Richmond to see this in a movie theater with great sound and stadium seating”, I’ll be hopping behind the wheel when Tubman hits the theaters on November 1st of this year.

The post The New Trailer For The Harriet Tubman Movie Is Out, and It’s Guntastic appeared first on Bearing Arms.

via Bearing Arms

The New Trailer For The Harriet Tubman Movie Is Out, and It’s Guntastic

Laravel Two-Step Registration: Optional Fields for Country and Bio

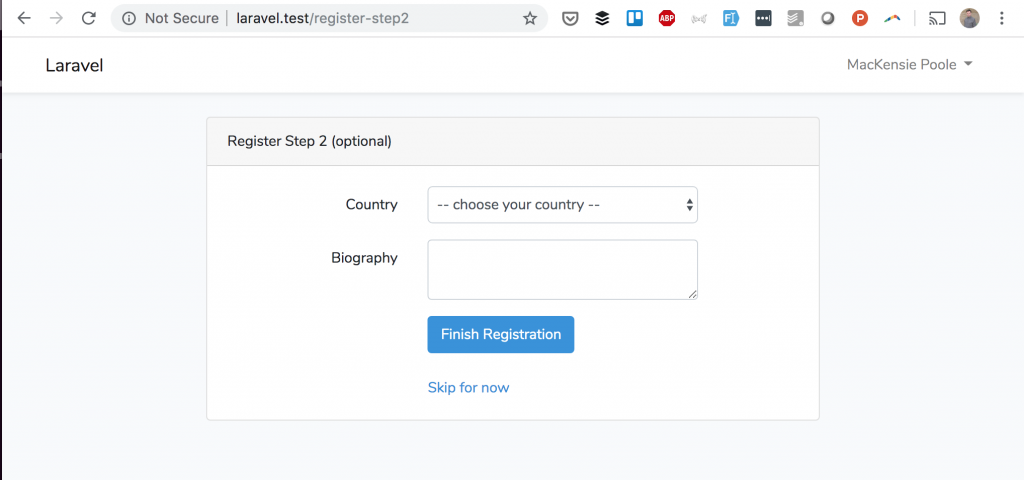

Nowadays, we have a lot of Laravel tutorial about some syntax or package, but I think there’s not enough written with real-life mini-projects, close to real demands of the clients. So will try to write more of these, and this is one of them: imagine a project where you need to have two-step registration process, with some optional fields in the second step. Let’s build it in Laravel.

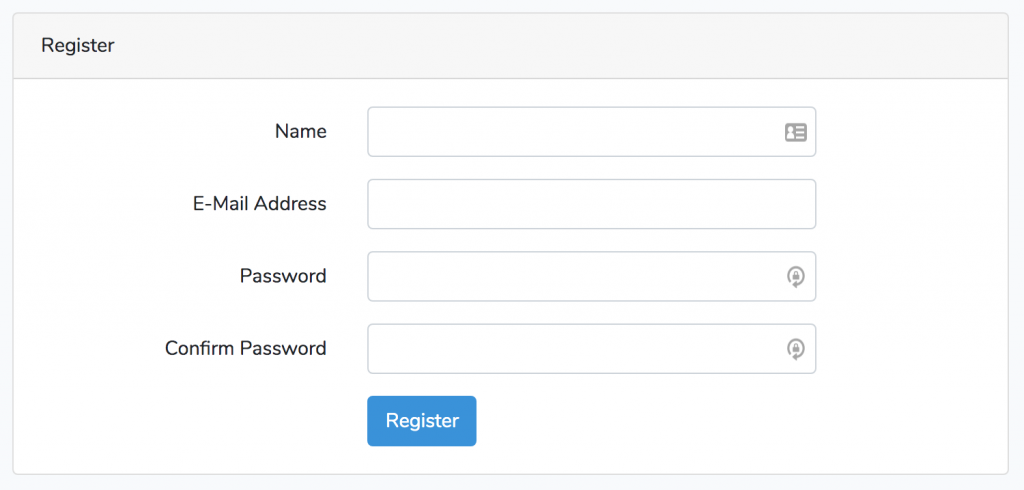

By default, Laravel registration form has four fields:

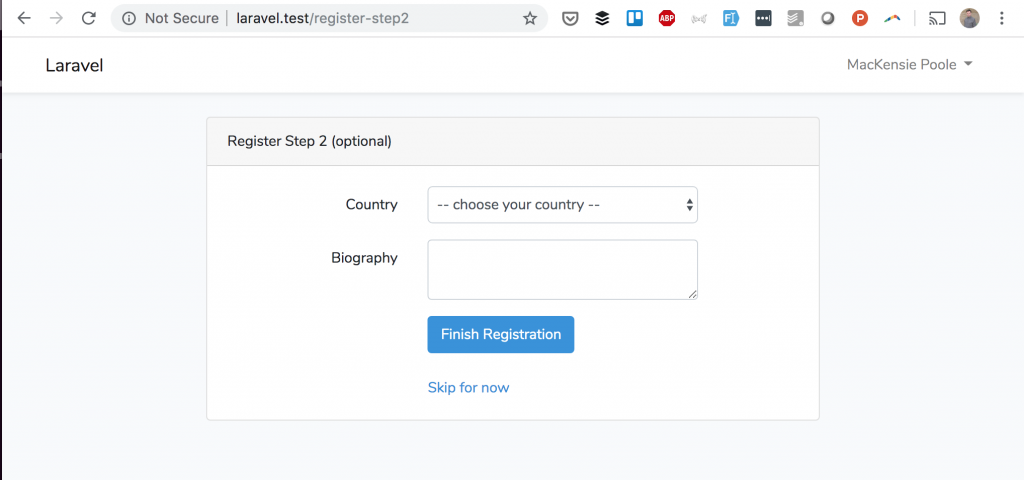

Let’s say we have a task to add two more fields: country (dropdown) and Biography (textarea). After successful default registration, user would be redirected to that second step with those two fields, and ability to fill them in, or skip that second step.

Here’s our plan of actions:

- Add new fields to User model and migration;

- For “country” field we would create a seed for all world’s countries;

- Create a GET URL /register-step2 and route/controller/view with form for those two new fields;

- Update that form values and redirect to /home;

- Add a link to Skip the second step;

- Finally, tie it all together to redirect successful registration to that /register-step2.

In reality, I will merge it all into four steps, let’s go.

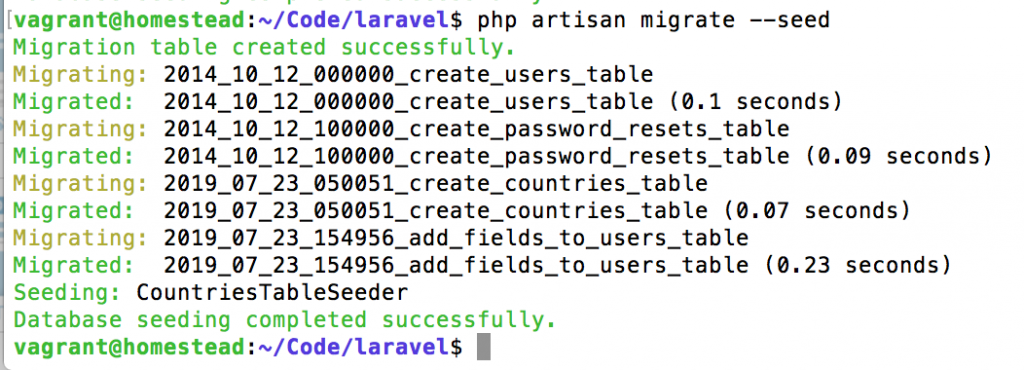

Step 1. New fields: migrations, seeds and model

We need to add two new fields to the database users table: country_id and biography. But before that, we need to create a new table countries to have a foreign key to.

So we launch:

php artisan make:migration create_countries_tableAnd for this we have a “quick hack” – there’s a seeder inside of our QuickAdminPanel generator, that will give us this:

class CreateCountriesTable extends Migration { public function up() { Schema::create('countries', function (Blueprint $table) { $table->increments('id'); $table->string('name'); $table->string('short_code'); $table->timestamps(); $table->softDeletes(); }); } }Also, we have the seed generated with all world’s countries:

class CountriesTableSeeder extends Seeder { public function run() { $countries = [ [ 'id' => 1, 'name' => 'Afghanistan', 'short_code' => 'af', ], [ 'id' => 2, 'name' => 'Albania', 'short_code' => 'al', ], [ 'id' => 3, 'name' => 'Algeria', 'short_code' => 'dz', ], // ... Other countries [ 'id' => 239, 'name' => 'Zambia', 'short_code' => 'zm', ], [ 'id' => 240, 'name' => 'Zimbabwe', 'short_code' => 'zw', ], ]; Country::insert($countries); } }And we add this seeder file into main database/seeds/DatabaseSeeder.php:

class DatabaseSeeder extends Seeder { public function run() { $this->call(CountriesTableSeeder::class); } }Now we can create a foreign key in users table:

php artisan make:migration add_fields_to_users_tableAnd here’s the migration code:

public function up() { Schema::table('users', function (Blueprint $table) { $table->unsignedInteger('country_id')->nullable(); $table->foreign('country_id')->references('id')->on('countries'); $table->text('biography')->nullable(); }); } Finally, we can launch this magic command on our (still empty) database:

php artisan migrate --seed

Registration Step 2: Route/Controller/View

So, we’re building this page now:

Let’s start with routes/web.php:

Route::get('register-step2', 'Auth\RegisterStep2Controller@showForm');Now, let’s the create the Controller we want, it will be in app/Http/Controllers/Auth/RegisterStep2Controller.php:

namespace App\Http\Controllers\Auth; use App\Country; use App\Http\Controllers\Controller; class RegisterStep2Controller extends Controller { public function __construct() { $this->middleware('auth'); } public function showForm() { $countries = Country::all(); return view('auth.register_step2', compact('countries')); } }As you can see, we add middleware auth inside of Controller’s constructor, so only authenticated users will be able to access that step 2 – immediately after registration.

Also, if you remember, one of the fields will be Countries list, so we need to pass it from Controller.

Now, let’s create a Blade file – for this, we will just copy-paste register.blade.php and change the input fields. Here’s the result resources/views/auth/register_step2.blade.php:

@extends('layouts.app') @section('content') <div class="container"> <div class="row justify-content-center"> <div class="col-md-8"> <div class="card"> <div class="card-header"></div> <div class="card-body"> <form method="POST" action=""> @csrf <div class="form-group row"> <label for="name" class="col-md-4 col-form-label text-md-right"></label> <div class="col-md-6"> <select name="country_id" class="form-control @error('country_id') is-invalid @enderror"> <option value="">-- --</option> @foreach ($countries as $country) <option value=""></option> @endforeach </select> @error('country_id') <span class="invalid-feedback" role="alert"> <strong></strong> </span> @enderror </div> </div> <div class="form-group row"> <label for="name" class="col-md-4 col-form-label text-md-right"></label> <div class="col-md-6"> <textarea class="form-control @error('biography') is-invalid @enderror" name="biography"></textarea> @error('biography') <span class="invalid-feedback" role="alert"> <strong></strong> </span> @enderror </div> </div> <div class="form-group row mb-0"> <div class="col-md-6 offset-md-4"> <button type="submit" class="btn btn-primary"> </button> <br /><br /> <a href="">Skip for now</a> </div> </div> </form> </div> </div> </div> </div> </div> @endsection As you can see, we’re adding “Skip for now” link to /home route. Also, we’re referencing the POST action to the route name register.step2 that doesn’t exist yet. This is our next step.

Step 3. Update the Fields

This is pretty simple, we just add a new method to our new Controller, and point to it in Routes. Remember, in the Blade file above, we already referenced it:

<form method="POST" action="">So, we need to add a new line in routes/web.php:

Route::post('register-step2', 'Auth\RegisterStep2Controller@postForm') ->name('register.step2');Our postForm() method will be as simple as that:

use Illuminate\Http\Request; class RegisterStep2Controller extends Controller { // ... other methods public function postForm(Request $request) { auth()->user()->update($request->only(['biography', 'country_id'])); return redirect()->route('home'); } }To make this work, we also need to make those two new fields fillable, in app/User.php – just add them into already existing array:

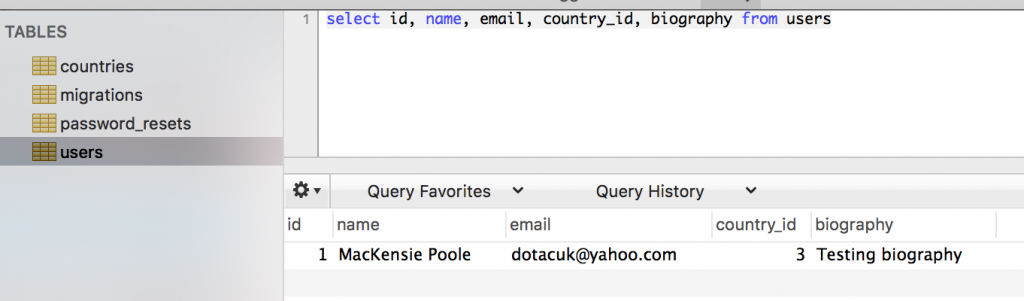

class User extends Authenticatable { use Notifiable; /** * The attributes that are mass assignable. * * @var array */ protected $fillable = [ 'name', 'email', 'password', 'country_id', 'biography' ];And, after we login/register, go to /register-step2 URL, fill in the form – we get success in the database:

Step 4. Redirect Registration to Step 2

Final step is probably the most simple one. By default, successful Laravel registration redirects user to /home URL, it is set in app/Http/Controllers/Auth/RegisterController.php:

class RegisterController extends Controller { /** * Where to redirect users after registration. * * @var string */ protected $redirectTo = '/home'; // ... } So, all we need to do is change the value to this:

protected $redirectTo = '/register-step2'; And, that’s it, our tutorial is done!

Here’s a link to Github repository for full project:

https://github.com/LaravelDaily/Laravel-Registration-Step2

via Laravel Daily

Laravel Two-Step Registration: Optional Fields for Country and Bio

Zorg Industries ZF-2

On a recent episode of his series Savage Builds, Adam Savage decided to see if he could replicate the functionality of the awesome 6-in-1 weapon known as the Zorg Industries ZF-1 from The Fifth Element. Here, he shows off the finished build. You’ll need to tune in to see it in action though.

Slack’s Desktop App Now Launches 33% Faster, Uses 50% Less Memory

Slack today announced it’s deploying an under-the-hood upgrade for its desktop app to boost performance for companies and teams using the app for workplace collaboration. From a report: The latest version of Slack for desktop and internet browsers is due out in the coming weeks and promises a 33% faster launch time, 10 times faster launch of VoIP calls, and roughly 50% less memory usage. The news comes a month after Slack became a public company, listed as WORK on the New York Stock Exchange. Slack product architect and lead of desktop client rewrite Johnny Rodgers said the upgrade takes advantage of changes to Slack’s underlying technology, like modern JavaScript tools and techniques and the React UI framework.

Read more of this story at Slashdot.

via Slashdot

Slack’s Desktop App Now Launches 33% Faster, Uses 50% Less Memory

Netflix’s ‘The Witcher’ teaser trailer revealed at Comic-Con

Late last year we learned that The Witcher’s TV adaptation found its Geralt in the form of Superman star Henry Cavill, and now at Comic-Con fans have their first glimpse of the live-action series coming to Netflix. The teaser trailer was unveiled at a panel discussion, where Variety reports Cavill said he campaigned "passionately" for the role and that he’s a big gamer who also did all of his own stunts.

There’s no release date on the trailer itself, but at least we have an idea of the monsters Geralt will be facing — both human and otherwise.

Source: Netflix

via Engadget

Netflix’s ‘The Witcher’ teaser trailer revealed at Comic-Con