75 percent.

The government of Vermont cut contract approval times by 75 percent when it switched to electronic signatures. Weeks of work became days. Hours of administration turned into minutes. Workers skipped printing, costly couriers, waiting around, and filing.

A small change, like a signature, can prove powerful — 75 percent powerful. Is your organization ready to cut inefficiencies by three-quarters or more?

Some pundits forecast the electronic signature market will grow to $2.02 billion by 2020. Every organization needs signatures, and every organization wants to optimize them.

E-signatures, as electronic signatures are also known, are replacing written signatures. Not only do they save time and money, but they also create less waste and are traceable, time stamped, and more secure. Most important, they’re legally equivalent to written signatures.

Traditional “wet” signatures have been with us for thousands of years. They came in many different forms, including stamps, marks, signs, and seals. However, traditional signatures are quickly becoming outdated as new technology reshapes our world. New ways of signing are simpler and easier. E-signatures are the future that citizens and consumers want, so you need to understand how they work.

What exactly is an electronic signature? The following is a complete guide to electronic signatures: their legality, practical uses, and much more.

Legitimacy of e-signatures

Are electronic signatures legally binding? The short answer is yes. The long answer is: Different countries have different laws.

In the United States, the ESIGN Act states that electronic signatures are fully legal as long as all parties agree to use them. In addition to the ESIGN Act, the Uniform Electronic Transactions Act outlines state use of e-signatures. Similar legislation exists in the European Union.

Despite existing legislation, you might need to investigate further online. You can also consult legal counsel for more specific, country-by-country details.

In the United States, you can use an electronic signature for creating a law. Courts allow you to present an electronic signature as evidence in a court case. Moreover, a document, record, or contract can’t be denied just because it’s electronic.

Rest assured, choosing an electronic signature solution won’t harm your organization from a legal standpoint. However, providers must fulfill some conditions for an electronic signature to be legally valid:

- Demonstrate the signer had definite intent to sign. For example, provide a clear option not to sign.

- Prove the signer consented to conduct their business electronically. Most electronic signatures require you give consent before signing. Some might provide the option to complete the form on paper.

- Clearly attribute the signature. This could include an email trail, IP address, or time stamp. Some providers have a two-step identification system for signers. Although this creates an extra step for the signer, it creates a higher standard of attribution.

- Associate, or directly connect, the signature with the document being signed.

When you satisfy these requirements, an electronic signature will be legally binding. Remember that the above conditions might already be incorporated into a provider’s solution.

If electronic signatures are just as legal, why aren’t they used in every situation?

Exploring the legal framework

In some cases, an electronic signature is not perceived as appropriate. This might be the case for important documents and ceremonies such as adoption, divorce, and birth and death certificates. Multiple witnesses or a notary are sometimes required, nullifying the convenience of electronic signatures delivered remotely. Another reason for not using e-signatures is if signees aren’t computer literate.

Some key court cases have challenged and tested e-signature laws. Here are the precedents from four relevant cases:

- O’Connor v. Uber. Even if an electronic signature is on a tiny iPhone screen, the signature is still valid.

- Berkson v. Gogo. Web page design, hyperlink placement, and contract terms must not be designed to confuse or mislead signers.

- Barwick v. Geico. The phrase “in writing” can refer to a signature written electronically.

- Adams v. Quicksilver. Attribution of an electronic signature needs an auditable trail of data. Others shouldn’t be able to break into that data trail and make changes.

There’s much to learn from real-world examples. Electronic signatures feature in every part of our lives with success. Almost any industry can enjoy digitizing its sign-off procedures.

Examples of different uses

All sectors need contracts, agreements, and forms. You use them to start a company, run an employee background check, and hire subcontractors on a construction site. As a result, e-signatures are everywhere. Electronic signatures can fit in almost any industry, government, or legal application.

Here are a few cases where electronic signatures have proven successful:

- Healthcare. For a hospital department, reducing the time it takes to get signatures from doctors, patients, and insurers is vital. In one radiology department, the time needed to get signatures for abdominal examinations dropped from 11 to three days. The time needed for signatures related to chest examinations dropped from 10 to five days. By using e-signatures to shorten or skip steps in employees’ workflow, productivity rose.

Without e-signatures, the future functions of healthcare — long-distance treatment, virtual hospitals, and medical e-commerce — cannot be easily achieved.

- Industrial relations. Electronic signatures help traditional organizations get more organized. The same holds true for unions. With changes in policy regarding e-signatures, gathering employee information is much faster. E-signatures also link better with online social networks, helping spread the union’s reach. With e-signatures, unions can organize privately and with higher participation and impact.

- Small to medium enterprises. When you’re a small fish competing with whales, it helps if you can swim fast and confirm prices as they change. Agility in commerce is highly valued and for good reason.

Speed can spread to other areas, such as faster sales cycles, product iteration, and more responsive customer service. E-signatures enable leaders to buy into agility and sign contracts minutes after they’re drafted.

- Government. Petitions changed forever after the introduction of electronic signatures. Consider a public petition to cancel the United Kingdom’s Brexit deadline. It collected millions of signatures in a few months. Electronic petitions reach a wider audience and spread faster than their wet-signature equivalents.

- Family law. One of the final frontiers for e-signatures, electronic wills have been legal in Nevada since 2001. Arizona and Indiana have followed suit. Most other states still require will creators to sign before two witnesses who also sign the document.

- Disability services. The move to online information allows consumers with visual challenges to manage their business better. Handheld devices and desktop computers can enlarge document font size. Some consumers may opt to use a text-reader program to read text out loud.

- Seniors. It’s a myth that older citizens don’t use online services, like e-signatures. About 42 percent of adults aged 65 and older have smartphones. That number is up from 18 percent in 2013. Internet use and home broadband adoption among this group have also risen. Today, 67 percent of seniors use the internet — a 55 percent increase in 20 years.

- Finance. There are many different ways to use an electronic signature in finance. In the United States, credit and loan forms frequently allow e-signatures. Digital mortgages are becoming more commonplace. After February 2018, most states adopted national standards for online notarization.

According to a Federal Reserve survey, if faced with an unexpected expense of $400, four in 10 adults would either not be able to cover it or would cover it by selling something or borrowing money.

One option for covering such an expense is a signature loan, a popular method for borrowing money. The process of securing a signature loan can be improved by using e-signatures.

Electronic signature operations

What is a signature loan?

Personal lending is the fastest growing category of consumer lending. Outstanding balances in the United States rose about 18 percent to $120 billion in the first quarter of 2018.

A signature loan is a loan offered by a financial provider to an individual. These loans are sometimes known as “character loans” or “good faith loans.” The only collateral is the individual’s promise to pay and a signature.

Due to limited collateral, interest rates for signature loans can be high. They range anywhere from 5 to 30 percent and depend on the payer’s circumstances and credit record.

Signature loans are popular for debt consolidation. For example, imagine you have several large credit card debts accruing interest at rates of 20 percent or more. A bank might offer you a signature loan at a lower interest rate. After you pay off your credit cards with the loan, you then pay back the loan amount to the bank. You save money because the debts are consolidated and the interest on the loan is reduced.

Signature loans are also an alternative to a secured loan if you need to make a large one-time payment. In the wake of the 2008 credit crisis, signature loans became a popular choice because they don’t put your home equity at risk. However, because there’s no collateral, a financial provider might demand higher interest. Alternatively, they could demand a more stringent repayment schedule.

Before taking out a loan, always compare different financial providers, the products they provide, and the fees they charge. Shop around to find the best option for your situation. Repayment methods for signature loans can vary; they include

- Variable rate. The interest rate is based on a changing index and can fluctuate over time.

- Fixed rate. The interest rate remains the same for the life of the loan.

- Payday. Also called cash advances, these small, short-term loans often have higher interest.

- Convertible. This type of loan can convert into shares or stock and often has lower interest.

- Single-payment. The principal and interest on this type of loan is repaid in one payment on an exact date.

Some financial providers, like SoFi, consider more information than a borrower’s credit score. They also consider your occupation, education, and the possibility of a cosigner.

By using e-signatures, online lenders can process applications immediately and furnish a decision within few minutes. Depending on the financial provider you choose, you can receive a signature loan within a few hours or by the next day.

E-signatures are not only useful for financial services. They’re now an everyday part of many software solutions, including Microsoft Office and Adobe products.

Adding or removing an electronic signature from a Microsoft Word or Adobe PDF document

While it might be 35 years old, Microsoft Office is still a dominant software suite in the business world. Keeping up with the times, Office products, such as Word, now integrate e-signatures into documents.

Signing Word files may seem daunting, especially if you’re used to pen and paper or you’re not familiar with the software. First-timers or anyone who needs a refresher on how to sign Word or PDF documents can benefit from this guide.

First of all, it’s important to understand the difference between electronic signatures and digital signatures. This guide discusses the electronic signature, the equivalent of your handwritten signature. An e-signature is merely an image of your signature overlaid on a Word or PDF document.

On the other hand, a digital signature is cryptographically secure data. It verifies that someone with your private signing key has seen the document and authorized it. It’s very secure, but it’s also more complicated. Digital signatures are the online equivalent to a notarized signature. Refer to the next section in this guide for more details on digital signatures.

Using an e-signature line in a Word document, you can request information about the signer and provide instructions. When an electronic copy goes to the signer, this person sees the signature line and a notification requesting their signature. The signer can

- Type a signature

- Select a picture of an inked signature

- Write a signature by using the inking feature on a touchscreen computer or other device

How to create a signature line in Word or Excel (Office 365 or 2019):

- In the document, place your cursor where you want a signature line.

- On the Insert tab in the Text group, click the Signature Line list. Then, click Microsoft Office Signature Line.

- In the Signature Setup dialog box, type the information that will appear beneath the signature line:

- Suggested signer: the signer’s full name

- Suggested signer’s title: the signer’s title, if any

- Suggested signer’s email address: the signer’s email address, if needed

- Instructions to the signer: instructions for the signer, such as “Before signing the document, verify that the content is correct”

- Select one or both of the following checkboxes:

- Allow the signer to add comments in the Sign dialog box: The signer can type in the purpose for signing.

- Show sign date in signature line: The date the document was signed will appear with the signature.

To add additional signature lines, repeat these steps.

If the document remains unsigned, the Signatures Message bar appears. Click View Signatures to complete the signature process.

To remove electronic signatures from Word or Excel, follow these steps:

- Open the document or worksheet that contains the electronic signature you want to remove.

- Right click the signature line.

- Click Remove Signature.

- Click Yes.

In addition, you can remove a signature by clicking the arrow next to the signature in the Signature Pane and then clicking Remove Signature.

Alternatively, you might require an electronic signature in a PDF document. See the next section for how to use e-signatures in PDF files.

Electronically signing a PDF file

Adobe’s Portable Document Format (PDF) is a common format for fixed-layout documents. Like Word, Adobe PDF has added a range of capabilities since it was introduced to the market in 1993. It’s now possible to electronically sign a PDF file for authentication.

If you’re a Windows user, you’re probably familiar with PDF readers. They are computer programs that allow you to open PDF files, that is, files with the .pdf file extension. The most popular option these days is Adobe Acrobat Reader.

To add an electronic signature to a PDF, follow these steps:

- Open the PDF file in Adobe Acrobat Reader.

- Click on Fill & Sign in the Tools pane on the right.

- Click Sign, and then select Add Signature.

- A popup will open. Select an option — Type, Draw, or Image.

- Click the Apply button.

- Drag, resize, and position the signature inside your PDF file.

For further information on how to add an electronic signature to a PDF using third-party tools, refer to our complete guide to editing PDFs.

Knowing how to sign PDF documents will give you an edge in today’s online world. For more of an advantage, you may need to be familiar with the language and technology surrounding digital innovations. The next section will look at one of the most confusing aspects of e-signatures.

The difference between e-signatures and digital signatures

“The [Digital Signature] Standard specifies a suite of algorithms that can be used to generate a digital signature. Digital signatures are used to detect unauthorized modifications to data and to authenticate the identity of the signatory.” — National Institute of Standards and Technology

Digital signatures and electronic signatures might sound alike, but they’re quite different. Digital signatures are cryptographic “nuts and bolts.” An electronic signature might just be a typed word, ticked box, or recorded voice. A digital signature is technology that uses complex mathematics to encrypt and decrypt data. This behind-the-scenes encryption is what makes electronic signatures work.

Digital signatures use PKI as a way to verify the identity of a signer. PKI uses two keys, one public and one private, for unique identification. Both the sender and recipient have a digital certificate from a certificate authority. These digital certificates work together like a driver’s license or passport and an ID reader.

For example, Company One needs Alex to sign a contract renewal. During the process, Alex signs using her private key, which encrypts the contract. Alex also gives Company One her public key. If the public key provided to Company One cannot decrypt Alex’s signature, the digital signature is rejected.

Depending on which digital or electronic signature you’re using, you might need to take extra steps for additional security. For example, you can use two-factor authentication. When triggered, it attempts to authenticate your identity by sending a message to your mobile phone. It makes sure the person signing is you and not someone using your login or key.

You may not always need such a high level of security. For low-risk scenarios, there are simpler security options offered through electronic signature providers. Do low-security options affect the validity of a signature? Not necessarily. For example, an e-signature provider without a digital signature can still identify a valid audit trail. They could get it by examining IP address, time stamps, or browser information.

When choosing an e-signature or digital signature solution, your organization will need to balance the needs of security, time, and cost.

As mentioned previously, both e-signatures and digital signatures are legitimate signatures. According to the ESIGN Act, an electronic signature does not have to be a typed name. What other types of signatures are acceptable?

Other e-signature types

Along with digital signatures and e-signatures, other types of electronic signatures are becoming commonly available.

Click-to-sign. A click-to-sign signature is a situation where a single click of the mouse signs the document.

There are legal conditions to be aware of if you’re using a click-to-sign solution. With click-to-sign signatures, the legal principles of intent, consent, attribution, and association still apply. For example, the signer must intend to click and consent to doing business this way. The signature needs an auditable trail of data that attributes the signature to the individual. Finally, the data needs to be directly associated with the document.

Before using click-to-sign on your documents, check local laws regarding these signatures. In most of the United States, click-to-sign is legally binding. Across the border in Canada, investment dealers can use e-signatures.

Blockchain. Originally used in cryptocurrencies, blockchain is now finding uses in mainstream industries, such as monitoring supply chains in fashion. The technology is useful for determining the authenticity of transactions using a distributed ledger. Blockchain is great for maintaining accountability, for example, of currencies like Bitcoin. However, it may not be as useful for situations when an individual or organization wishes to be anonymous.

Biometric signatures. Biometric signatures use information about your body to verify authenticity. They add a part of your body that’s unique to you, such as

- Fingerprints. Not just used at a crime scene or an airport anymore, fingerprints are now crucial to consumer technology. Fingerprint scanners are found on smartphones and on credit cards in the United Kingdom. While they provide extra security, they are not as safe as you might think. Researchers have developed “deep master prints” that can hack fingerprint scanners.

- Hand geometry. This method calculates the finger lengths and palm size of users.

- Eye scans. Eye scans analyze the patterns of blood vessels in the retina or colors and lines in the iris. These scans are difficult to fake because the patterns are unique to each person.

- Face ID. Infrared dots shoot out and measure a unique 3D face image. Used in the iPhoneX, Apple claims Face ID is 20 times harder to break than its fingerprint scanner.

- BioSig-ID. This authentication software captures unique movements and gestures as the signer draws a four-character password with a finger, stylus, or mouse.

While biometric signatures are harder to forge, they’re also harder to replace. For example, you can quickly create a new password if someone guesses yours. However, you can’t really come up with a new face if someone hacks your Apple Face ID.

Both complex and simpler types of signatures will continue to have their uses. The type of signature you choose will depend on the reason you need the signature. The level of security and sophistication should match the occasion.

In the next section, we’ll examine some common scenarios when you might need an e-signature.

When you need e-signatures most

Legally, you can use an electronic signature anytime you need a signature.

Practically, there are situations when you need simplicity, security, convenience, and a low cost. In these cases, you need an electronic signature.

Here are some more common scenarios when you need an e-signature:

- When you need a simple and intuitive solution. Streamline your HR services with electronic signatures. Consider using them on time-sensitive documents, like time sheets, tax forms, and onboarding forms for new hires.

- When you need high-level security. When dealing with highly personal information, you need 100-percent assurance. This could include retention or fee agreements, confidentiality agreements, or power of attorney agreements. In these cases, an e-signature could provide strong insurance through an auditable trail.

- When you need convenience and speed. Legal services, such as class action communications, might have to go out to hundreds or thousands of people. A quick batch of e-signatures could save you hours or even days. In retail, you could use speedy e-signatures to make sales and sign purchase orders and invoices. It’s sure to impress technologically minded business associates and keep business moving.

- When you need to lower costs. In finance, you’re always seeking to cut costs. With e-signatures, you could open, maintain, or close accounts at lower costs by eliminating shipping fees. Similarly, insurance companies can cut the costs of claim assessments or policy agreements by having customers sign online.

Collecting signatures via an online form can get rid of a lot of inconvenience. Instead of sending out forms and waiting for them to come back, you can receive signed documents from anyone at any time. To get that level of convenience, how can you set up signature forms on your website?

How can you apply e-signatures to your JotForm forms?

JotForm accepts electronic signatures, enabling you to authenticate, identify, and secure your form.

Creating an electronic signature for your form is simple. It only takes three steps:

- In the Form Elements menu, add E-Signature to your form from the Widgets tab. The e-signature widget allows signers to draw their signature using a mouse, finger, or other input device. The widget requires no additional configuration, and you can resize it to fit your form layout.

- Use the Properties menu to configure additional settings:

- Required: requires a signature to submit the form

- Hover Text: text that appears when the cursor hovers over the signature box

- Sub Label: text that appears below the signature box

- Duplicate: copies the field with all of the same settings

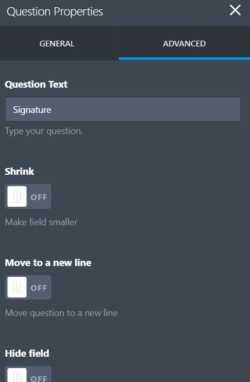

- In the Advanced Properties tab, refine the look of your e-signature using

- Question text

- Shrink

- Move to a new line

- Hide field

Remember that signers must consent to provide their signature electronically for it to be legally binding. This also applies when they are completing your form. For example, if a signee makes a financial decision to subscribe to your service, you must establish clear consent. Otherwise, you could face legal action down the road.

The popularity of e-signatures continues to grow. Globally, the amount of e-signatures is projected to grow 34.7 percent annually. Which companies are embracing electronic signatures and offering new solutions?

Electronic signature apps and software

When selecting an e-signature provider, there are a few factors you should take into account:

- Price. Some providers offer products exclusively for business and can be expensive. Others cater to lower budgets. Most offer multiple products and services and free introductory trials.

- Security. Check the technical specifications the provider uses for identification and authentication. Not every company will use digital signatures. Another issue may be customer service availability — who is available to fix your problem if and when one occurs?

- Experience. Has the provider worked with companies of your size in your industry? Read reviews from their customers.

- Integration. How will the e-signature service work with your existing software? This could have a significant impact on your ability to streamline your workflow.

Also, be sure to look for solutions that include the features your organization needs. Depending on your business, you might need

- Custom branding for your signatures

- Scalability, depending on the size of your company and the number of users who will need to use the service

- Regulatory compliance to meet the laws that govern your industry

- Reporting, workflow visualizations, and dashboards for managers to track progress

- Notifications and reminders that prompt signers to complete a signature

- Mass signatures for sending out signatures to a large number of people at once

There are many e-signature providers available, and many will likely satisfy your needs. To find the best fit, check the features different companies provide and weigh them against your business needs.

Here is a rundown of the most popular e-signature providers on the market today:

DocuSign

- High price

- First-class security

- Good for large enterprises

“DocuSign is the largest e-signature player by market share and will maintain this position for the foreseeable future.” — Neil Wynne, How Will DocuSign Going Public Impact the Electronic Signature Market?

Founded in 2003, DocuSign pioneered some of the key technologies used in e-signatures. Today, the company has more than 475,000 customers and hundreds of millions of users across the world.

You can use DocuSign’s cloud platform. DocuSign works on Mac and Windows, and it integrates with Google, Salesforce, and many other apps.

DocuSign offers excellent security and encryption solutions. It’s the only provider to be ISO 27001 and SSAE 16 certified. In addition, DocuSign also complies with the xDTM Standard — the transaction management standard for an open, digital world.

It all adds up to a first-class service at a first-class price. Individuals or casual users pay $10 per month. The standard plan for multiple users is $25 per user per month. If you’d like to try DocuSign, it’s also available as a 30-day trial.

Adobe Sign

- Trusted name in software

- Experienced and secure

- Good for large organizations

As the second biggest player on the e-signature market, Adobe offers a trusted solution suited to professional use. In fact, many choose Adobe based simply on reputation. It’s one of the most well-known and trusted names in software.

In 1999, Adobe introduced some of the first digital signatures in Adobe Acrobat and Adobe Acrobat Reader. Since then, the company has worked with experts and certificate providers across the industry to create an open standard.

Today, Adobe is the “first global vendor to deliver open, standards-based digital signatures for web and mobile.” The company has worked with experts in the Cloud Signature Consortium to set up a new global standard.

Adobe Sign provides world-class compliance and authentication features built in. It’s also Microsoft’s preferred e-signature solution, so you can take care of signature tasks without ever leaving Office 365.

Pricing for a single user is $9.99 per month. For two to nine users, you’ll need to sign up for Adobe Sign Team, which costs $24.99 per person per month. The price for 10 or more users is $39.99 per user per month. A free 14-day trial is also available.

SignEasy

- Mobile and simple

- Fast and easy to use

- Good for business use

SignEasy’s focus has been on mobility and simplicity. Founded in 2010, SignEasy features secure sockets layer (SSL) technology to encrypt all data transferred between the application on your device and their servers.

Reviews are very positive; however, some reviewers have noted slight interface glitches, lengthy loading times, and the lack of company branding options.

SignEasy uses secure servers at Amazon Web Services to store your files, and only you can access the files with your user credentials. SignEasy works with a variety of apps, including Gmail, Zoho, Google Drive, Dropbox, and Evernote. Users can also sign without leaving the applications they’re working in.

The price is on par with other solutions at $10 per month for individual users with limited needs. To access additional features, other individual plans are priced at $15–$20 per month. Finally, the rate for teams is $60 per month for up to three users. SignEasy also offers a 14-day trial.

KeepSolid Sign

- Modestly priced

- Simple to use

- Offers useful templates

As the name implies, KeepSolid Sign is a sturdy mid-level solution for everyday mobile and multidevice needs. It’s a native app for iOS, macOS, Android, and Windows.

Established in 2013, this newer player on the market does not yet support digital certificates and digital signatures from a Certificate Authority. However, it’s not a lightweight on security. KeepSolid Sign comes with military grade AES-256 encryption.

In reviews, users have noted the handy templates that can reduce the time needed to prepare documents. Some reviewers have observed that the interface might not be suited for larger, more complex tasks.

In terms of cost, KeepSolid is relatively inexpensive. It comes with a 14-day trial, and the single-user rate is $9.99 per month. Teams with up to five members pay $34.99 per month, and larger teams of 10 or less pay $64.99 per month.

Secured Signing

- A cheap solution for low-volume needs

- Fast (according to reviews)

- Versatile for individuals or business

Founded in 2008, this New Zealand-based company offers some impressive features.

Secured Signing includes a cloud-based digital signing service, including a signing workflow with invitations, automated reminders, and signing progress in real time. The X.509 digital signature technology that underpins Secured Signing ensures the authenticity of signees and documents.

While customer reviews stress that the program is fast, some have complained about a confusing interface, lack of features, and no mobile app.

The basic plan is free if you need to send three documents or fewer a month. For up to 10 documents a month, there’s a pay-as-you-go rate starting at $9.95 per month. For companies with higher volume, the team edition starts at $24.95 per month. The price varies based on the number of users and the number of documents sent.

OneSpan

- More expensive

- Long list of features

- High customer satisfaction

Formerly eSignLive by VASCO, OneSpan emphasizes its record of working with governments and regulated industries. Founded in 1991, OneSpan has over 10,000 customers, including more than half of the world’s top 100 banks.

Customer reviews mention ease, flexibility, and security as some of the software’s positive qualities.

When it comes to maintaining trust and achieving the highest completion rates possible, brand consistency is a large concern for big organizations. For a reasonable cost, OneSpan allows companies to deliver highly personalized digital experiences that put their brands front and center.

OneSpan leverages its experience by offering a generous 30-day free trial. After that, it’s $20 per user per month.

Why electronic signatures are essential

Signatures have come a long way since early scratchings on cave walls. As history and technology have shaped society, our signatures have changed as well.

Electronic signatures have countless advantages over wet signatures — they’re fast, environmentally friendly, cheap, and traceable. E-signatures also have many uses in everyday life and business. Today, the market for e-signatures is growing thanks to global commerce, security concerns, and environmental awareness.

The world produces more than 400 million tons of cardboard and paper annually. You can help end the waste caused by printing documents to be signed. Your adoption of new technology will impress your staff while improving your business.

Ultimately, the focus should be on customer convenience. Consumers want more control and choices through online services. Banks have already learned this lesson: 40 percent of consumers say their mobile phone is their principal device for interacting with their bank.

Adapting to new technology is a challenge. However, technology offers many rewards and the opportunity to get more people excited about your organization. Don’t leave electronic signatures out of your operations. E-signatures not only make your operations faster and cheaper — they also make work that much easier.